Feel free to search our blog for any specific content related to you or your claim, the insurance process, or feel free to scroll through posts below:

Filing an insurance claim can be complicated, and homeowners often make mistakes that lead to denied or underpaid settlements. Common errors include not understanding the policy, waiting too long to file, and failing to document the damage properly. At VIP Adjusting, we help homeowners avoid these pitfalls and ensure their claims are handled fairly for maximum compensation.

Navigating an insurance claim can be complex and overwhelming, making it essential to hire a Public Adjuster early in the process. These professionals advocate for homeowners, ensuring higher claim reserves and avoiding costly mistakes. By leveraging their expertise, you can secure the compensation you deserve while streamlining the claims process.

Soot damage from a fire often causes more extensive and costly damage than the fire itself, contaminating air ducts, walls, and surfaces throughout a property. As a toxic substance, soot poses serious health risks and must be addressed in any fire damage insurance claim. VIP Adjusting specializes in identifying and documenting soot damage to ensure homeowners and businesses receive the maximum compensation from their insurance claims.

When your mortgage company is listed as a payee on your insurance check, it's to protect their financial interest in the property. This often leads to delays as they require documentation to ensure funds are used for repairs. To expedite the process, provide signed contracts and consider hiring a public adjuster for assistance.

When buying a property with an ongoing insurance claim, understanding the claim’s impact is crucial. From Assignment of Benefits (AOB) transfers to securing new insurance, VIP Adjusting helps you navigate the complexities, ensuring the claim is fairly adjusted and your investment is fully protected. Let us guide you through the process and maximize your claim settlement.

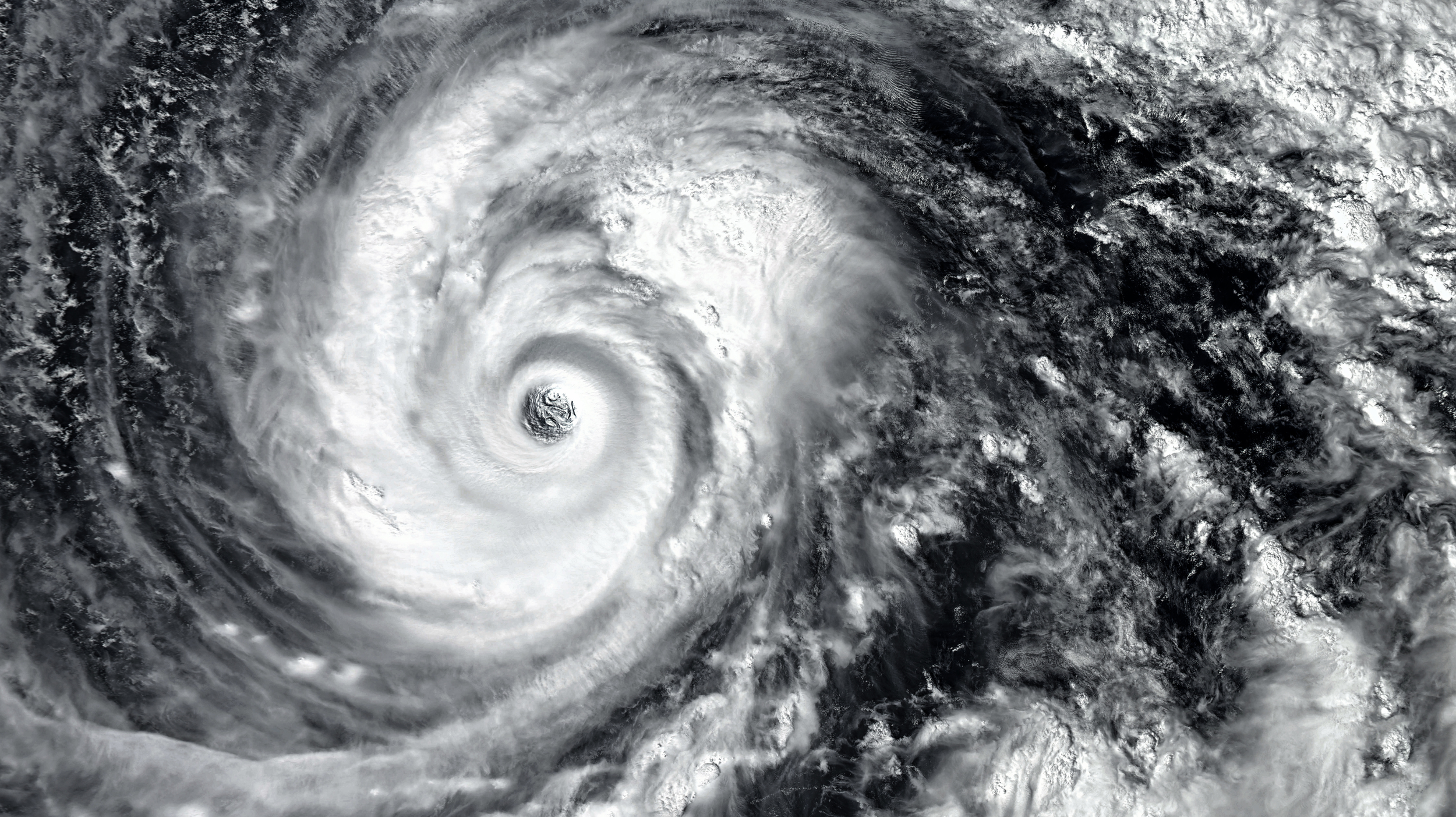

On Monday, August 5th, Hurricane Debby made landfall in Steinhatchee, Florida, as a Category 1 hurricane with maximum sustained winds of 80 mph. The storm brought heavy rain, high winds, and significant flooding to many parts of Florida, causing widespread damage and prompting numerous rescue operations.

Discover the hidden clauses in your insurance policy that could limit your rights. Our latest blog post shines a light on the anti-public adjuster endorsement. Learn how these endorsements work, their implications, and how we can help. Don't let complex language stand in the way of your protection. Read more about your rights and how to ensure you're fully covered.

If you've received a puzzling letter from Citizens Property Insurance Corporation in your mail, you're not alone. Dive into our latest post where we break down Citizens depopulation program and its direct impact on your policy. Understand what the change means, identify the type of notice you've received, and discover your next best steps. Knowledge is your safeguard in these shifting sands!

Don't wait for a leak to learn how to shut off your home's water supply! This guide will familiarize you with your home’s plumbing system and help you locate all necessary valves.

Thinking of selling your Florida home while an insurance claim is still pending? Learn how that decision impacts your payout, depreciation recovery, and Additional Living Expenses. Discover what rights you keep, what you give up, and how to protect yourself during the sale.